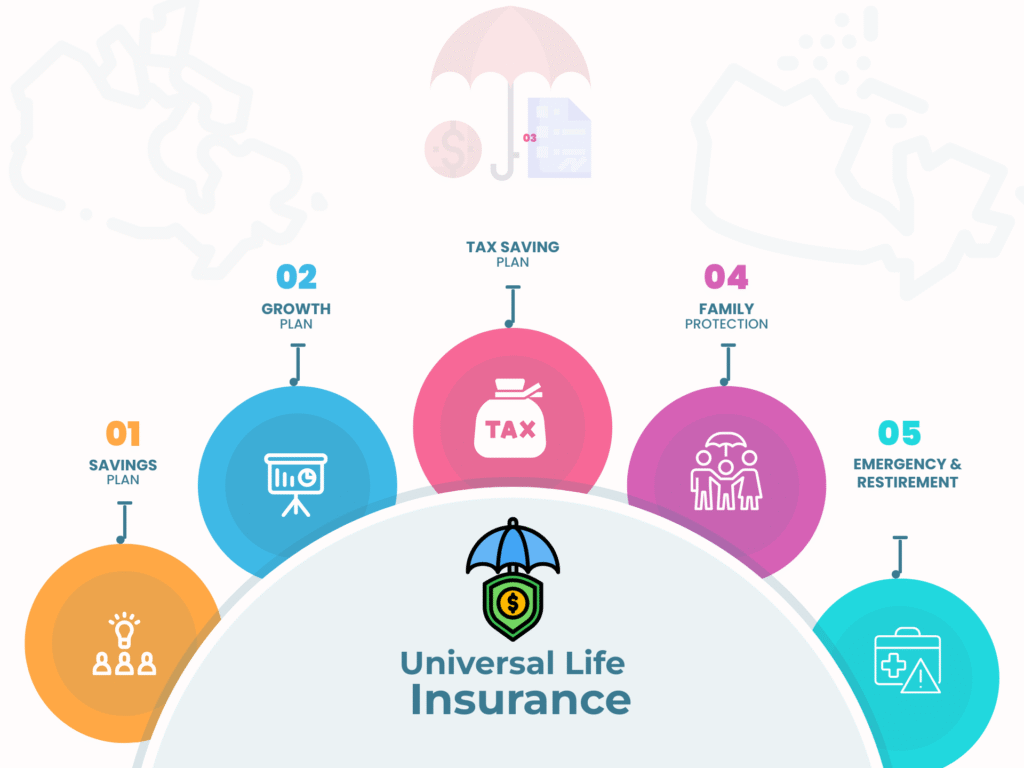

Universal Life Insurance

iRateCompare offers universal life insurance plans that combine lifelong protection with investment opportunities. Our solutions allow you to build wealth over time while securing your family’s future.

At iRateCompare, we know that Canadians value stability, flexibility, and the ability to leave something meaningful behind. That’s why Universal Life Insurance is one of the most powerful tools we offer — it gives you lifelong protection while helping you grow your wealth in a tax-advantaged way.

Made for Canadians: Whether you’re building your future in Toronto, Vancouver, Calgary, or a small town in Atlantic Canada — this is coverage built for your life, your family, and your values.

Access Your Funds Any Time

One of the main benefits of universal life insurance is the ability to access the cash value that builds up over time. Unlike traditional life insurance policies, universal life insurance in Canada gives policyholders the option to withdraw from or borrow against their policy’s cash value. This added flexibility can be especially helpful during financial emergencies or major life events.

The accumulated cash value can be used for a range of purposes, including large purchases, unexpected expenses, or supplementing retirement income. However, withdrawals and loans come with specific terms and may affect both the policy’s performance and the death benefit. It’s important to carefully review your policy and speak with your insurance provider to fully understand any consequences. With this access to funds while keeping life insurance protection in place, universal life insurance offers a flexible and practical financial solution.

How it Works

- Premiums are deposited into an investment account.

- Each month, the following costs are deducted from the account:

- Premium tax

- Cost of insurance

- Cost of any riders and additional benefits

- Policy administration fees

- Investment returns are credited to the account.

- As long as there are sufficient funds in the cash account to cover these costs, the policy remains in force.

- Lump-sum deposits can be made at any time to boost the account value.

- If investment returns exceed projections, premium payments may be skipped.

- If investment returns fall short of projections, additional deposits may be required to keep the policy active.